You can print a 725 sales tax table here. The Department of Revenue announced Friday that so-called remote sellers must obtain a sales tax permit and begin collecting the tax by Jan.

Illinois Doubled Gas Tax Grows A Little More July 1

The minimum combined 2022 sales tax rate for Lincoln Nebraska is 725.

. September 16 2019. The December 2020 total local sales tax rate was also 7250. The state sales tax rate stands at 55 percent or around five and a half cents for ever dollar spent.

It was approved. Lincoln NE Sales Tax Rate The current total local sales tax rate in Lincoln NE is 7250. Form 3800N - Nebraska Employment and Investment Credit Computation for All Tax Years.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. In Lincoln another 15 percent or one and a. The Nebraska state sales and use tax rate is 55 055.

City of Lincoln Mayors Office 2019 Media Releases. The Nebraska state sales and use tax rate is 55 055. The decision follows a US.

A no vote was a vote against authorizing the city to increase the local. The Lincoln sales tax rate is 175. ACT is hosting the meetings to focus on new street work to be funded by the quarter-cent sales tax approved by voters in April.

For city sales and use tax purposes only these boundary changes are effective on the date identified in the column titled Effective Date. The 725 sales tax rate in Lincoln consists of 55 Nebraska state sales tax and 175 Lincoln tax. Lincoln on the Move.

There are no changes to local sales and use tax rates that are effective January 1 2022. Potential Use of Quarter Cent Sales Tax for New Construction to Promote Private Sector Investment Draft as of August 26th 2019 Legend Annexation Agreements. The filing deadline for this election was March 7 2019.

Did South Dakota v. Form NOL Nebraska Net Operating Loss Worksheet Tax Year 2019. There are no changes to local sales and use tax rates that are effective July 1 2022.

AP Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state. Form CDN 2019 Nebraska Community Development Assistance Act Credit Computation. Raised the state sales tax rate from 55 to 625 a 14 increase.

More information is available at streetslincolnnegov. Nebraska sets 2019 deadline for online sales tax collections. There is no applicable county tax or special tax.

025 lower than the maximum sales tax in NE. The sales tax increase. This is the total of state county and city sales tax rates.

The County sales tax rate is 0. Of this new revenue to be collected starting October 1 2019 a minimum of 25 must be apportioned to construction of new non-residential streets to promote private investment. The city of Lincoln Nebraska held general elections for mayor city council Districts 1 2 3 and 4 and one of five elected seats on the airport authority on May 7 2019A primary was scheduled for April 9 2019.

Begin collecting sales taxes on candy pop bottled water plumbing services moving services and veterinary services for pets among others. Provided state school aid of 33 of total education costs per pupil to all schools. The group is asking the City Council to place on the April 9 primary ballot a measure to raise the City sales tax one-quarter cent for six years starting October 1 2019.

A sales tax measure was on the ballot for Lincoln voters in Lancaster County Nebraska on April 9 2019. Effective April 1 2022 the city of Arapahoe will increase its rate from 1 to 15. Ballot Question April 9 2019.

A yes vote was a vote in favor of authorizing the city to increase the local sales tax by an additional 025 percent a quarter cent for six years to fund street improvements. Increased cigarette taxes 56 to 1pack. Although candidates had the option to file with political parties city elections were nonpartisan and political parties.

Free Unlimited Searches Try Now. Ad Get Nebraska Tax Rate By Zip. In year one FY 19-20 the proposed.

Updated March 3 2022 The following cities have adopted ordinances or made plat changes which have modified their city boundaries. What is the sales tax rate in Lincoln Nebraska. AP - Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state.

The Nebraska sales tax rate is currently 55. Lincoln City-Lancaster County Planning Department Sales Tax Funds for New Street Construction Proposed Strategy August 26 2019 _____ The following is a proposed strategy from the Lincoln Transportation and Utilities Department and the Planning Department for use of the quarter cent sales for new street construction. Supreme Court ruling that gave states the authority to.

Potential Funding Examples of Additional Potential Projects µ 0 05 1 2 Miles Document Path. The state sales tax rate in Nebraska is 55 but you can customize this table as needed to reflect your applicable local sales tax rate. For additional information on these boundary changes contact the city clerk of the appropriate city.

Tax Commissioner Tony Fulton announced the following changes in local sales and use tax rates for the upcoming quarter starting on April 1 2019. Form 1040XN 2019 Amended Nebraska Individual Income Tax Return. In April 2019 the City of Lincoln voters approved a six-year 14 cent sales tax to be used for street improvements and construction.

Shall the City Council of Lincoln Nebraska increase the local sales and use tax rate by an additional one quarter of one percent ¼ upon the same transactions within such municipality on which the State of Nebraska is authorized to impose a tax for a period of six years for street. For tax rates in other cities see Nebraska sales taxes by city and county. Nebraska is giving online businesses until 2019 to start collecting sales taxes on orders placed within the state.

/cloudfront-us-east-1.images.arcpublishing.com/gray/GAN5CWJIAFGV5LYYD6342D4OBU.png)

Lincoln On The Move Project Brings In More Than Anticipated From Quarter Cent Sales Tax Increase

Vehicle And Boat Registration Renewal Nebraska Dmv

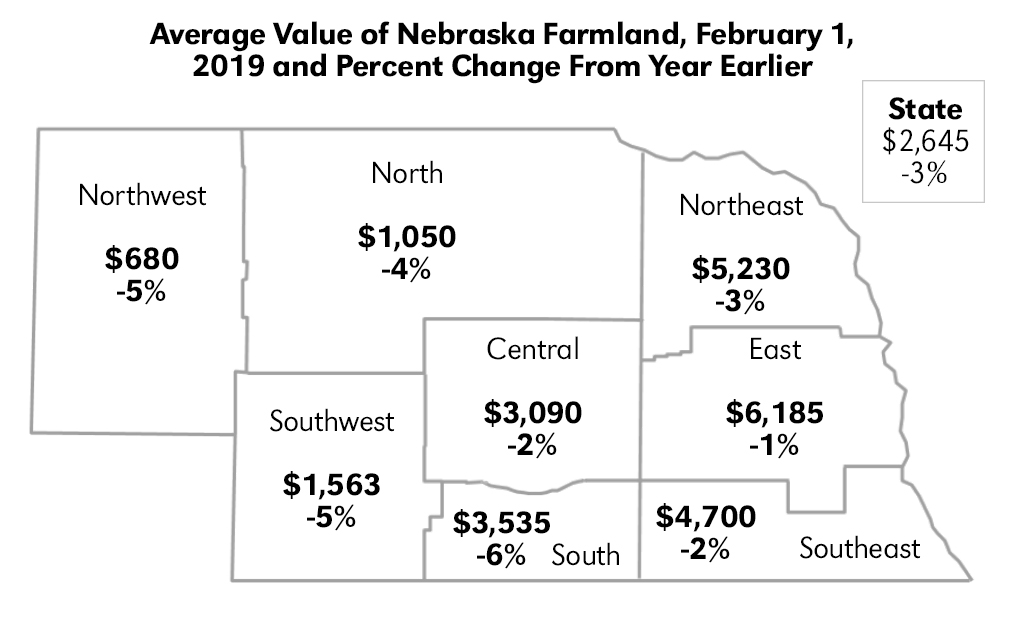

2019 Nebraska Farm Real Estate Report Agricultural Economics

New Cars Suvs Trucks Dealership In Lincoln Ne Anderson Ford Anderson Mazda Of Lincoln

Nebraska Income Tax Ne State Tax Calculator Community Tax

/cloudfront-us-east-1.images.arcpublishing.com/gray/KX4IFSPUWRNTZL56FJJKSPUMF4.jpg)

Lincoln To See New Sales Tax Revenue Starting October 1

Lincoln Nebraska Ne Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Nebraska Sales Tax Guide And Calculator 2022 Taxjar

2019 Nebraska Property Tax Issues Agricultural Economics